When Tailwinds Vanish

Emailed on April 24th 2020 in The Friday Forward

Keeping with this theme of newly-famous essays, John Luttig penned a piece this week that I suspect will gain a lot of traction in the coming weeks.

"When Tailwinds Vanish" has quickly garnered the attention, and approval, of many of Silicon Valley's wisest investors as they look to the next decade.

If you own a new business or startup, I highly recommend you read this essay this week. For the rest of the lazyweb, I've got a few highlights:

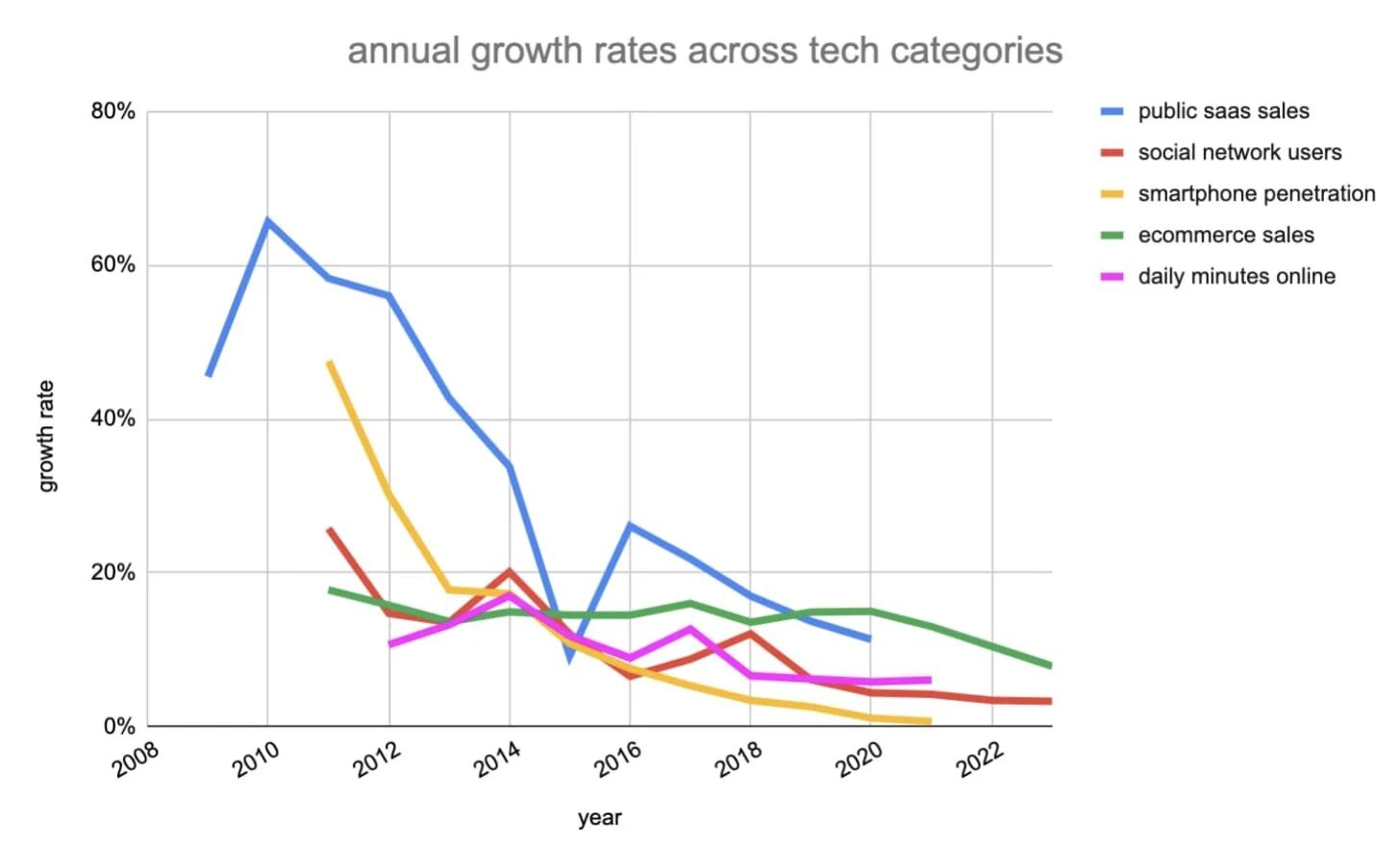

Carefully measured growth will win: The "blitzscaling" playbook (growth at all costs) is more fitting as a reflection on the past two decades than as a prescription for the 2020s. When the ecosystem-level diseconomies rival the company-level economies of scale – “first to scale” may become “first to fail”. Unit economics matter more than ever.

Focus will shift from R&D to SG&A: Today, startups tend to focus on problem spaces where there is higher operational and go-to-market complexity.. This often means higher marginal costs to sell and provide services. More software sales reps chasing the same customers, and more ad dollars chasing the same clicks, means more expensive customer acquisition.

Ask yourself this question: if you had an extra million dollars for your startup, where would you spend it? As a marketplace with a physical component – say, food delivery or ridesharing – you might spend this money on local ops and supply acquisition. As a SaaS company, you’d spend an extra million to hire more sales reps or run a marketing campaign.

These SG&A investments are a prerequisite to drive business growth. Relative to the R&D-driven growth of early Internet companies, SG&A will become the primary growth vector in the 2020s.Understand growth levers: As Internet companies invest more into SG&A, they’ll have a clearer understanding of their growth levers.

ROI has become more predictable as it shifts from R&D to SG&A: in contrast to an engineer, a salesperson or operations leader can drive a quantifiable amount of value to your top line (growing revenue) or bottom line (increasing LTV).

Expect and embrace a new financial layer: As the ROI of SG&A spend becomes more predictable, a non-VC financial layer will emerge within Silicon Valley, similarly helping to fuel its growth. This capital layer can help partially compensate for the slowing market-based growth tailwinds. This suite of services will benefit from a tech-specific approach: real-time debt offerings based on operating KPIs, securitization of software ARR, and retail investor-facing SaaS bonds.

VCs will get back to funding vision: VCs will be rewarded for investing in vision, investing in companies with limited empirical data or historical precedent – which, after all, is the foundational idea behind venture capital.